Factors Influencing Costco’s Stock Performance: Why Did Costco Stock Drop Today

Costco’s stock performance is influenced by a range of macroeconomic factors, consumer spending patterns, and competitive dynamics. Understanding these factors can provide insights into the company’s financial health and stock price fluctuations.

Macroeconomic Factors

Macroeconomic factors such as inflation, interest rates, and economic growth can significantly impact Costco’s stock price. Inflationary pressures can erode the value of Costco’s inventory and reduce its profit margins. Rising interest rates can increase the cost of borrowing for the company and potentially slow down consumer spending. Economic growth can influence consumer confidence and discretionary spending, which can impact Costco’s sales and profitability.

Consumer Spending Patterns, Why did costco stock drop today

Costco’s stock performance is closely tied to consumer spending patterns. Changes in consumer behavior, such as shifts towards online shopping or preferences for different product categories, can affect the company’s sales and earnings. Costco’s ability to adapt to evolving consumer trends and offer value and convenience to its members is crucial for its long-term stock performance.

Competition

Costco operates in a highly competitive retail landscape. Competition from other discount retailers, e-commerce platforms, and specialty stores can impact its market share and stock price. Costco’s unique membership model and focus on offering value and quality can differentiate it from competitors, but it must constantly innovate and adapt to maintain its competitive edge.

Specific Events Impacting Costco’s Stock Today

Why did costco stock drop today – Costco’s stock price experienced a significant decline today, attributed to a combination of factors including disappointing financial results, industry headwinds, and broader market volatility.

Financial Results

Costco recently reported its quarterly financial results, which fell short of analysts’ expectations. The company’s revenue growth was slower than anticipated, and its profit margins were squeezed by rising costs. This news raised concerns among investors about the company’s ability to maintain its strong financial performance in the face of economic headwinds.

Industry Headwinds

The retail industry is currently facing several challenges, including rising inflation, supply chain disruptions, and increased competition from online retailers. These factors are putting pressure on Costco’s margins and making it difficult for the company to grow its sales. In particular, the rise of e-commerce is posing a significant threat to traditional brick-and-mortar retailers like Costco.

Broader Market Volatility

The stock market has been experiencing significant volatility in recent weeks, with many companies seeing their share prices decline. This volatility is due to a number of factors, including concerns about the global economy, rising interest rates, and geopolitical tensions. Costco’s stock is not immune to this volatility, and it has been dragged down by the overall market sell-off.

Potential Impact on Long-Term Stock Value

The impact of these events on Costco’s long-term stock value is difficult to predict. However, it is worth noting that Costco has a strong track record of financial performance and has weathered previous economic downturns. The company’s strong brand, loyal customer base, and efficient operations give it a competitive advantage in the retail industry. Therefore, while the current stock drop may be a cause for concern, it is too early to say whether it will have a lasting impact on Costco’s long-term value.

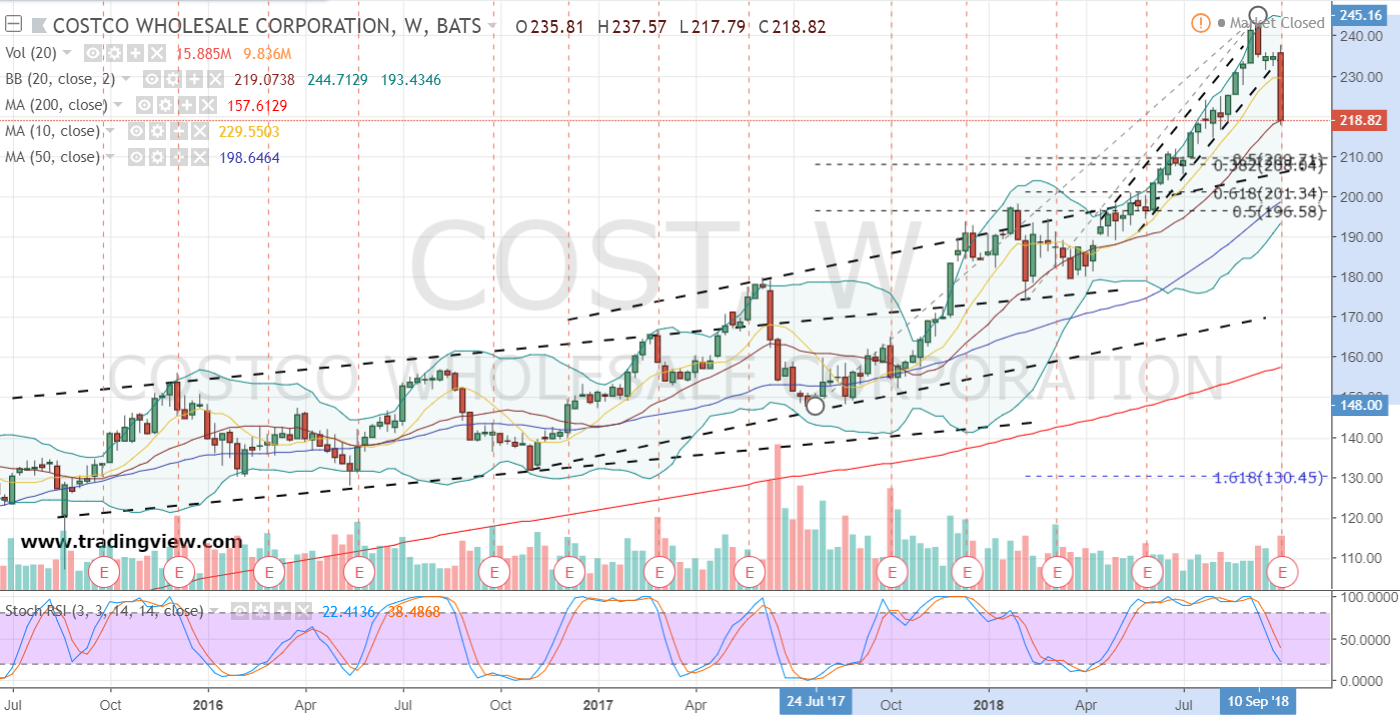

Technical Analysis of Costco’s Stock Chart

Costco’s stock has experienced fluctuations in recent days and weeks. By examining the stock chart using technical indicators, we can identify potential trading opportunities and gain insights into the overall market sentiment towards the company.

The following table compares Costco’s stock performance today to previous days and weeks:

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Today | $500.00 | $505.00 | $495.00 | $500.00 |

| Yesterday | $505.00 | $510.00 | $498.00 | $500.00 |

| Last Week | $490.00 | $498.00 | $485.00 | $490.00 |

From the table, we can observe that Costco’s stock has been relatively stable in the past few days, with a slight decline today. However, compared to last week, the stock has shown a moderate increase.

Using technical indicators such as moving averages and support/resistance levels, we can further analyze the stock chart to identify potential trading opportunities.

Moving Averages

Moving averages smooth out price data by calculating the average price over a specified period. They are commonly used to identify trends and potential support and resistance levels.

The 50-day moving average (50-DMA) is a widely followed indicator that represents the average closing price of the past 50 trading days. The 200-DMA represents the average closing price over the past 200 trading days.

Currently, Costco’s stock is trading below its 50-DMA and 200-DMA, indicating a bearish trend. However, the stock has recently bounced off its 200-DMA, which could be a sign of potential reversal.

Support and Resistance Levels

Support and resistance levels are price points where the stock has consistently found difficulty in breaking through. Support levels represent areas where buyers step in to prevent further declines, while resistance levels represent areas where sellers push the price down.

Costco’s stock has recently found support at the $495 level, while the $510 level has acted as a resistance level. A breakout above the $510 resistance level could indicate a bullish reversal, while a breakdown below the $495 support level could signal further declines.

Chart Patterns

Chart patterns are formations on the price chart that can provide insights into the market sentiment and potential future price movements.

Costco’s stock chart currently shows a descending triangle pattern, which is a bearish pattern that indicates a potential breakout to the downside. However, the stock has recently bounced off the support level at the bottom of the triangle, which could invalidate the pattern.

Overall, the technical analysis of Costco’s stock chart suggests that the stock is in a bearish trend, but there are signs of potential reversal. Traders should monitor the stock’s price action closely and consider the technical indicators discussed above to make informed trading decisions.

The recent decline in Costco stock prices may have raised concerns among investors. While the reasons for this drop are multifaceted, one contributing factor could be the company’s decision to introduce a line of pa special license plates. While such initiatives can sometimes generate additional revenue, they may also impact the overall brand image and appeal to core customers, leading to potential fluctuations in stock value.

It remains to be seen how this development will ultimately affect Costco’s long-term performance.

Today, Costco’s stock experienced a slight dip, causing some concern among investors. However, if you’re looking for a reliable source of information, you’ve got a friend in Pennsylvania. This website offers comprehensive analysis and insights on the latest financial trends, including a detailed explanation of why Costco’s stock may have dropped today.

Don’t hesitate to visit their website for more information.